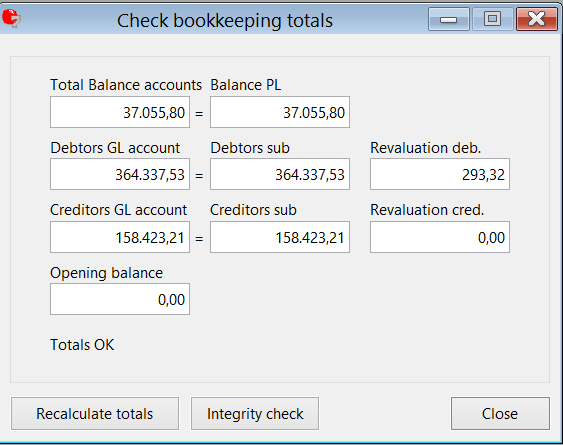

This option is very useful to check the bookkeeping.

On opening the screen, various numbers are calculated to check if the bookkeeping is in balance.

Although the totals may appear to be correct, it is useful to start the "Integrity check" by pressing the button.

The function can be started via menu Supervisor > Book > Recalculate bookkeeping totals or by using the button at the Trial balance screen.

First some tests are done and the totals will be shown on the screen.

During this test issues that cause a difference will be solved and reported immediately.

When after this test the totals match, a message appears: "Totals OK".

If a difference exist, the message "Execute recalc bookkeeping totals" appears on the screen.

The following checks are made.

Settings

1. First P&L account

In order to present the right general ledger accounts on the P&L of the trial balance, Mill7 needs to now what the first general ledger account is that should be presented on the P&L. When this setting is not made the trial balance will not be correct.

Adjust in menu Maintenance > Settings > Book.

2. First balance code P&L

This setting is used to determine the beginning of the P&L in the balance code table.

The check will be performed for the table set as the default for the bookkeeping at Settings > Book > General.

This setting has no influence on the integrity of the bookkeeping, only on the default balance presentation.

Adjust in menu Maintenance > Balance codes.

3. Errors in VAT codes

General ledger accounts are entered at the VAT codes.

Errors in the account entered are reported.

Adjust in menu Maintenance > Financial > VAT by entering a correct general ledger account.

The system will ask you to recalculate the bookkeeping to correct the bookkeeping.

This is not necessary If no bookings where made on this VAT code.

4. Errors in a diagram

Mill7 uses diagrams to indicate which numbers are used for general ledger accounts, debtors and creditors.

The diagram for debtors and creditors also contains information about the daybook that is used for those bookings.

Errors in the daybook entered here are reported.

Adjust in menu Maintenance > Financial > Diagrams by entering a correct daybook.

The system will ask you to recalculate the bookkeeping to correct the bookkeeping.

This is not necessary If no bookings where made on debtors or creditors.

5. Errors in the definition of a daybook

Every daybook is linked to a general ledger account. If errors occur in this information this will be reported.

This account can be changed even if journals have been made in the daybook.

Adjust in menu Maintenance > Financial > Daybook by entering a correct general ledger account.

The system will ask you to recalculate the bookkeeping to correct the bookkeeping.

Journals

6. Errors in journals

All journals are checked on the account that is used in the journal.

If a journal exist with a non-existing account or with no account this will be reported.

Adjust in the journal entry screen by changing the account. Please check if no other information changes in the journal.

7. Daybook page does not exist.

Journals are created in daybook pages. If a page does not exist this will be reported.

Adjust by recalculating the bookkeeping totals. The pages will be created.

8. Errors in daybook totals

The total of the daybook does not correspond with the total on the general ledger account that goes with the daybook.

Adjust by selecting the concerning daybook in the journal entry screen. Press F4 in the Page field.

Press Recalculate in the list that appears.

The totals and automatic journals in the daybook pages will be checked and recalculated if necessary.

Integrity check

Errors in the settings of the bookkeeping may lead to differences in the balance sheet.

This function checks the settings and will report errors (e.g. general ledger accounts without a balance code or incorrect balance codes).

Errors found by the integrity check are not corrected automatically.